loans

More News

-

Banks hesitant to fund wheat buying

ECC members say provinces should seek loans on their own without govt guarantee

-

Soaring debt pile worries industrialists

Businessmen ask govt to avoid more loans by promoting local brands

-

K-P to seek royalties to repay loans

CM’s adviser says govt has prepared its case for demanding royalties, other outstanding dues

-

SBP facilitated govt debt: report

Says central bank provided indirect loans to govt leading to high inflation

-

Pakistan seeks investment, not loans

PM asks friendly nations to pour capital, calls for harnessing youth potential

-

$600m commercial loan linked to IPP debt

Chinese officials say working to accomplish the task promptly, no condition attached

-

IMF sees $8b dip in debt in two years

Reduced CAD, restructuring initiatives with China drive projected decline

-

FM warns of unsustainable debt

Says tackling debt position should be 'top priority' of reform agenda

-

IMF and Pakistan

Caretaker Finance Minister hints that more loan programmes will be needed as the economy remains fragile.

-

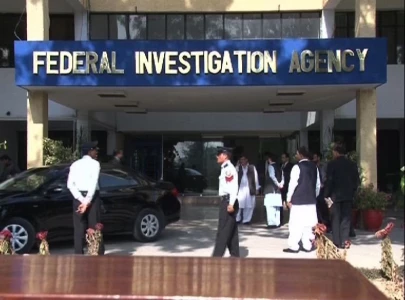

111 apps offering jobs, loans banned, Senate told

Bugti says FIA confiscated Rs1.8 billion interest amount