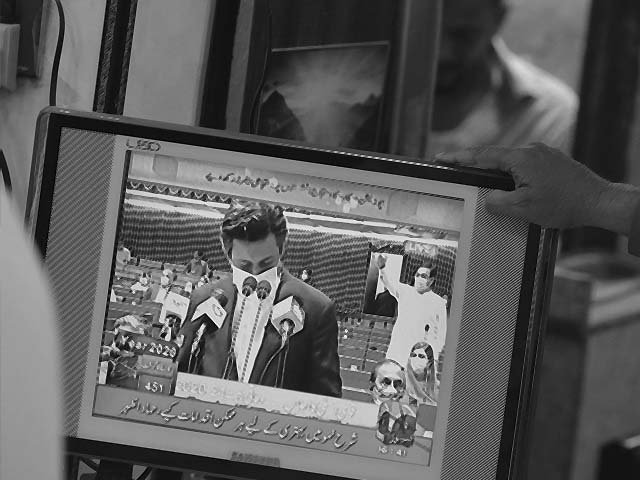

Pakistan budget 101: How comfortable does the future look?

History repeats itself by passing the impact of taxes onto the common man in a society of pass-it-on-to-the-consumer.

Each family manages its affairs by assessing the financial health and consequently, deciding the expenditures correspondingly. Striving to balance between the present and future lifestyle, we all inadvertently end up ‘budgeting’ our lives to the best of our understanding.

While we fail to criticise our individual budgeting misnomers, nonetheless, we anxiously wait for the honourable finance ministers to present the country’s financial outlay and shape our future every year. After all, the government bears the (ir) responsibility of our well-being, doesn’t it?

Let us break the budget for the Fiscal Year 2014-15 in a crystallised form for us to pin-point the eventual impact on the lives of various stake holders.

1. Low to middle class:

Positives:

- Increase in minimum monthly wage to Rs12,000

- Increase in minimum pension to Rs6,000

- 10% increase in the government employees’ salaries

- Benazir Income Support Program monthly allowance increased from Rs1,200 to Rs1,500

- Health insurance for poor people Rs1 billion

- Government’s reliance on foreign loans to shore up FX reserves. Rupee needs to depreciate by less than six to seven per cent in order to maintain cheaper interest cost - lower rupee depreciation would lead to lower imported inflation

- Single digit inflation to lead to possible reduction in interest rate making it affordable to take loans in order to purchase cars, homes or set up businesses

- Public sector development program Rs525 billion – generate employment and improve electricity and infrastructure

- Allocation to railways increased from Rs28 billion to Rs40 billion – new locomotives and/or cheap fares and better quality

- Reduction in general sales tax on tractors to 10% - tractor prices to come down

- Federal excise duty on telecommunication companies to come down from 19.5% to 18.5% – marginal decline in mobile bills

- Finished textile and leather to be taxed at 17% – protecting local industry

- Rs25 billion subsidies for Urea import – government prioritising giving gas to power sector and import Urea at cheaper levels. Local Urea prices surge to remain nominal owing to excess supply

- Reduction in taxes on marriage halls

- Reduction in duties on import of UPS from 20% to 15%

Negatives

- Reduction in electricity subsidy from Rs323 billion to Rs203 billion – hike in electricity bills

- Motor tax increased by 50% to 100%

- Gas Infrastructure Development Cess (GIDC) increased to Rs300/mmbtu on CNG, fertiliser, cement, textiles and other industries – another round of inflation

- Federal excise duty enhanced on cements and cigarettes

- Minimum tax of one per cent on FMCG distributors

- 17% duties on rapeseed, canola seed and sunflower seed – inflationary

2. Upper middle class:

- 7.5% advance tax on electricity bills more than Rs100,000

- Bonus shares taxed at five per cent – high net worth individuals are major players in the stock market as well as bond market

- Increased duties on international travel

- Capital gains tax increased – the stock market has already matured at current levels

- 50% exemption from taxes and duties on hybrid vehicles below 1800cc and 25% above 1800cc – middle class can still not afford these expensive vehicles

- 16% duty on chartered flights charges

- Withdrawal of federal excise duties on locally manufactured +1800cc vehicles – Toyota Fortuner and Hilux to become cheaper if the assemblers pass on the benefit

3. Businesses and corporations:

- Retailers with less than Rs20,000 electricity bill to taxed five per cent and above Rs20,000 at 7.5%

- Steel manufacturers to witness higher electricity tariff – increased construction costs

- Increase in custom duty for flavouring powder and dyers – inflationary

- Increased tax on brokerage of advertising agents - inflationary

- Increased tax on services, contracts and goods

- Preferred tax treatment for coal mining projects in Sindh

- Lower corporate tax for foreigners investing in Pakistan with at least 50% equity

- 15% tax on imported dyes apart from the ones used in textile manufacturing - inflationary

- Reduction in export refinance rate and long term finance facility – increased exports

- Alternative Corporate Tax (ACT) at 17% of accounting income – adjustable over next 10 years

- Reduction in corporate tax to 33% excluding banks, oil and exploration companies

- Capacity tax on aerated waters to revert to normal tax regime – to all Pakola lovers, the drink shall survive!

The government has also, in principle, decided to bring additional people in the tax-net. Also, since voluntary filing of returns was not making any headwinds, the government decided to force people into filing their tax returns through following measures:

Encourage filing of returns:

- 0.5% withholding tax on cash withdrawals for non-filers and 0.3% for filers

- Advance tax on property worth more than three million rupees. One per cent for filers and two per cent for non-filers

- 10% withholding tax on dividend and interest income for filers and 15% for non-filers

- Three per cent tax on business and first class airline tickets for filers and five per cent for non-filers

- NTN is a mandatory requirement for obtaining commercial or industrial gas or electricity connections

- Advance motor tax has 100% double rates for non-filers (impact of Rs18,000 – 120,000)

- Vehicle registration has 25% to 80% higher rate for non-filers (impact of Rs5,000 to 200,000)

- Sale and transfer of immovable property. 0.5% for filers and one per cent for non-filers

In a nut-shell, the government seems to have adopted a ‘wait and watch’ strategy. It seems another bitter pill would be swallowed, of course by the masses, to enable the government to align the budget. Invariably, due to the pricing power, businesses would conveniently pass down the impact of any additional taxes. History repeats itself by transferring the impact of taxes onto the common man in a society of oh-pass-it-on-to-the-consumer.

While the measures to tax the elite and discourage the non-filers with hefty financial taxes are acts worth applauding, we are yet to observe concrete structural steps taken to ‘fix’ the economy. The cash-strapped continues to hand over most of the revenues to pay the burgeoning mountain of debt and a never falling defence budget.

Following questions, nonetheless, continue to be unanswered:

- Do we not need to allocate more resources to the untapped human capital?

- Does the ever dwindling state of the public health sector need no attention?

- What surety is offered to ensure that the tax on businesses would not be passed on as tax on masses?

- The privatisation of profitable entities is being undertaken at the expense of loss making units. The golden goose is being sacrificed merely to create a so-called positive sentiment for the cancerous units such as railways, PIA, Pakistan steel mills and discos? Wow!

- The rampant raid on electricity theft is hardly visible lately. Has the government succumbed to the business lobby?

- Why is the federal government pretending to be so helpless in imposing tax on agriculture? The common man is already bearing the brunt of inflation, the landlords shall too.

- Do we continue to label ourselves as a defensive state or make choices to lead economically as South Korea and Japan has done?

- How long would we wait to document the black economy that runs into size of multiples of GDP? Nigeria has recently changed the mixture of GDP to reflect the true size.

- When will the government officials take into consideration the people’s frustrations at petrol stations where they have to wait two hours to save Rs500 every third day? Congratulations, Pakistan is ranked number one by Bloomberg on ‘Pain at the Pump’.

- The rich have invariable become richer, even by corrupt means. Would we never see their trial, will the government continue to forgive their past sins through mischievously crafted NROs or will we have to resort to a Thailand’s yellow-revolution?

Nations have only progressed owing to the vision of the leaders and more importantly, capabilities of the masses. The incumbent government’s two years shall pass within a jiffy without any material improvement on the lives of the common man. A common man has rather been shunned as an ‘ordinary man with a vote’.

Our nation has a lot of patience, resilience and short term memory to forgive (and forget) the misdealing of our masters. The silenced Pakistani could one day be labelled as ‘those who kept quiet and let more than 50 million Pakistani youth breathe but not progress’. The common man may eventually demand ‘a trial on streets’.

COMMENTS (5)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ